“Amulet Hotkey is a world leader in high performance computing.”

Stewart Holness

TREUN Capital have invested into Amulet Hotkey, allowing management to buy out the majority retiring shareholder and providing additional growth capital. Amulet is a global leader in high performance computing.

About Amulet Hotkey

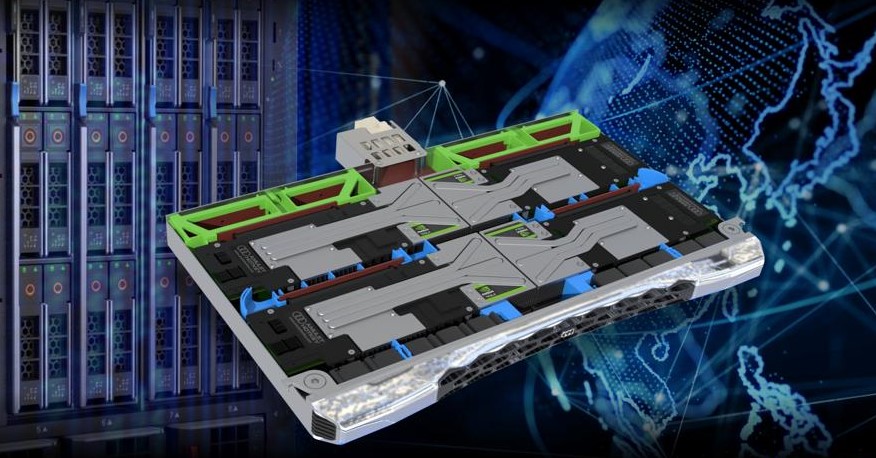

Amulet is an advanced technology manufacturer and system integrator headquartered in Heathfield, Devon, with offices in London, New York and Sydney. It designs, tests and manufactures best in class dense computing data centres and workstations and secure Zero Client and Thin Client end points.

As the global expert in dense and secure computing for mission critical operations, Amulet solves future market challenges with best in class Remote Computing, Hybrid Cloud, AI and Edge solutions. Its technology is embedded in large enteprises and governments across the global defence, finance, engineering, scientific and graphic intensive media sectors. It sells direct and partners with Dell, HP, Nvidia, Intel and integrators and acts as the key enabling interface between customers, engineers and sales to unlock or defend large global accounts and multi-year government contracts.

TREUN, as part of its value-add investment approach has backed a program of product development and introduced Stewart Holness to Amulet. Holness is an experienced industry operator, having run and grown several public and private software companies during his career. He joins Amulet as Executive Chairman and will work with the existing management team to grow the business. Holness says: “Amulet has exceptional capabilities that solve the problems faced by global institutions requiring high performance, gold plated system reliability, flexibility and security. It’s a hidden gem with a world class engineering team who have developed a suite of industry leading technology blocks and products addressing a large and fast-growing space. I am delighted to join and invest alongside TREUN Capital and look forward to helping steer Amulet to take advantage of its many global opportunities.”

For more information see www.amulethotkey.com.

“I am delighted to join Amulet Hotkey and invest alongside TREUN Capital.”

Stewart Holness

Executive Chairman

“Our style is straightforward and no nonsense.”

TREUN Capital

About TREUN Capital

TREUN invests more than cash. It was set up by private equity veterans Paul Canning and Alex White with a simple mission – help high potential businesses grow value faster and with more certainty. It aims to be a genuine investment partner, bringing senior team experience to bear on “best practice”, solving problems and avoiding pitfalls– experience gleaned from 25+ years of working with businesses on transformational journeys to create sustainable high value companies. Its experience, exceptional industry contacts and capital are best put to use for owners and managers to plug into in the “under-served” gap for equity investments in businesses valued up to £30m. For more information see www.treuncapital.com.